My mate Tony called me up last Thursday, proper excited. “Have you seen the Rolls Royce share price lately?” he asked. “I bought some shares two years back when they were dirt cheap. Now I’m wondering if I should cash out or hold on.” Fair question, really. I’d been watching RR shares myself and couldn’t believe what was happening.

So I started digging around to give Tony some proper advice.

The Rolls Royce Comeback Story

Let’s be honest; Rolls Royce nearly went broke during COVID. Aviation stopped. Nobody was flying. Their shares dropped to about 67p in late 2020. Absolute carnage.

But what a turnaround. The company’s been on a proper tear since then.

Rolls-Royce shares are up almost 800% since the start of 2023, which is mental when you think about it. That’s not a typo. Eight hundred per cent. If you’d stuck £1,000 into RR shares at the start of 2023, you’d have about £9,000 now.

The share price has climbed another 35% in 2025 alone, and we’re only in August. Makes you wonder if this rocket ship’s ever coming back down to earth.

Where’s The Share Price Right Now?

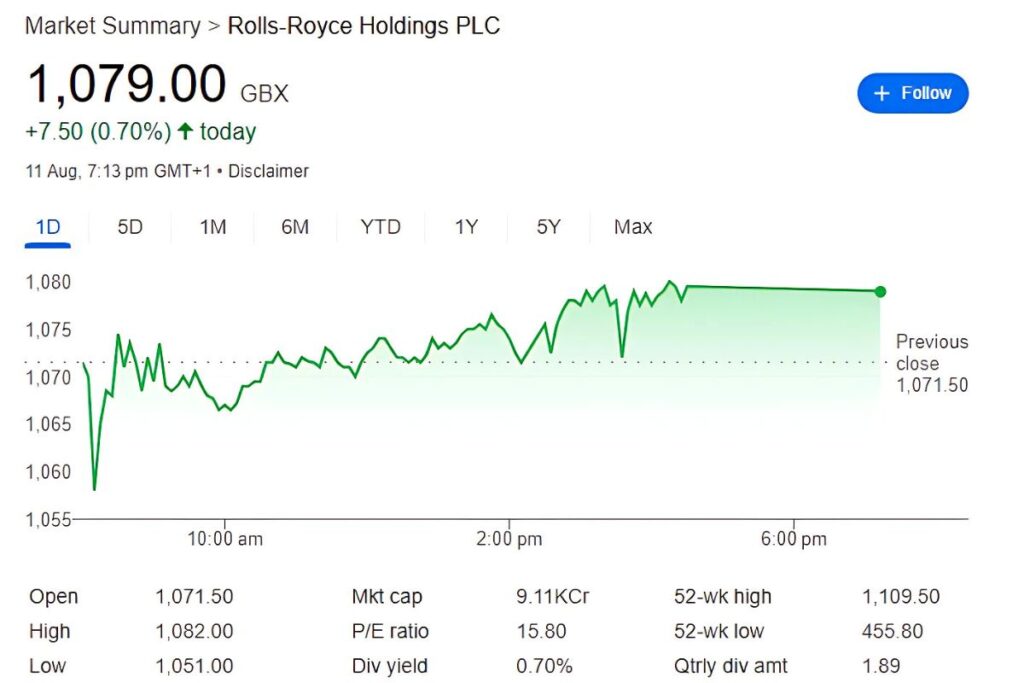

Current price hovers around 1,070p as of recent trading. That’s over ten quid per share. Mental, considering where it was a few years back.

Wall Street analysts are setting price targets with an average of 1,059.73p, with forecasts ranging from a high of 1,289.34p down to a low of 640.67p. Bit of a spread there, isn’t it? Shows nobody really knows what’s next.

Some analysts reckon it’s overvalued now. Others think it’s still got room to run. Welcome to investing, eh?

What’s Actually Driving The Price Up?

Aviation’s back, big time. People are flying again after COVID. Airlines are ordering new engines. Rolls Royce makes the Trent engines that power loads of long-haul aircraft.

But here’s the clever bit: they don’t just sell engines anymore. They sell “power by the hour” deals. Airlines pay based on how much they use the engines. More flights equal more money for RR. Brilliant business model when aviation’s booming.

Defence spending’s up too. Everyone’s worried about security these days. Rolls Royce makes engines for military aircraft and naval vessels. Government contracts are steady money.

They’ve also been cutting costs like mad. Got rid of thousands of jobs during COVID. Harsh, but it’s made them leaner. Better margins now.

The Rolls Royce Share Price Roller Coaster

This stock’s not for the faint-hearted. It goes up fast, but it can drop just as quickly.

During 2020 and 2021, watching the Rolls Royce share price was like watching paint dry. Boring, depressing paint. The company was burning through cash, diluting shareholders, and raising emergency funds. Proper mess.

Then 2022 happened. Aviation started recovering. Shares began climbing. Not quickly at first; more like a gentle hill than a mountain.

2023? That’s when things went properly mental. The share price took off like one of their Trent engines. Investors suddenly realised RR wasn’t going bust. They were going to make serious money again.

The share price has roughly tripled in the last 12 months, which gives you an idea of how fast this thing’s been moving.

What The Experts Reckon

City analysts are split, as usual. Some think RR’s fairly valued now. Others reckon it’s still got legs.

The bulls point to rising aviation demand, steady defence spending, and improved margins. They see more upside.

The bears worry about economic slowdown, high valuations, and the cyclical nature of aviation. They think a correction’s coming.

The truth is, nobody knows for sure. That’s why they call it the stock market, not the stock certainty.

Should You Buy Rolls Royce Shares?

Here’s my take, and I’m not a financial advisor, just someone who’s watched markets for years.

RR’s a cyclical stock. When aviation’s good, it soars. When aviation’s bad, it crashes. COVID proved that perfectly.

Right now aviation’s booming. Long-term, more people will fly. Emerging markets are growing. That’s good for RR.

But the share price has already run hard. A lot of good news is probably already baked in. You might be buying at the top

Also read: Santander Share Price Today

The Risks Nobody Talks About

Aviation’s cyclical. What goes up usually comes down. Economic recession could hammer airline demand overnight.

Competition’s fierce. General Electric, Pratt & Whitney; all these companies are not sitting still. RR needs to keep innovating to stay ahead.

Debt levels are still high from the COVID bailout. That’s a millstone around their neck for years to come.

Environmental pressure is growing too. Everyone wants cleaner engines. That means massive R&D spending with no guarantee of returns.

My Honest Opinion On The Share Price

The Rolls Royce share price run has been spectacular. Almost unbelievable if you lived through the COVID lows.

But here’s the thing: great companies can still be overpriced. RR’s a great company now, no doubt. But at these levels? You’re paying premium prices for premium quality.

If you already own RR shares, fair play. You’ve done brilliantly. Whether to sell depends on your situation. Need the money? Take some profits. Happy to hold long-term? Probably fine to stick.

If you’re thinking of buying now, Be careful. This train’s been moving fast. Might be time for a breather.

What I Told Tony

Back to my mate Tony’s question. What did I tell him?

“Mate, you’ve made a fortune already. Take some profits. Maybe sell half, keep half. That way, you’re not kicking yourself either way.”

The Rolls Royce share price story isn’t over. This company’s got decent prospects long-term. But after gains like these, a bit of caution never hurt anyone.

Aviation will keep growing. People will keep flying. But share prices don’t go up in straight lines forever. Even the best rockets eventually come back to earth.