My dad rang me Tuesday morning. “That Santander share you mentioned, what’s it doing today?”

Fair question. He’d bought some shares a few months back after I told him the bank looked solid. The problem is, he checks the price about seventeen times a day and panics every time it drops a penny.

“Dad,” I said, “you need to chill out about this.”

But I get it. Banking shares are mental to follow. One day they’re flying, next day they’re tanking. Santander’s no different.

What’s the Santander Share Price Today Actually Doing?

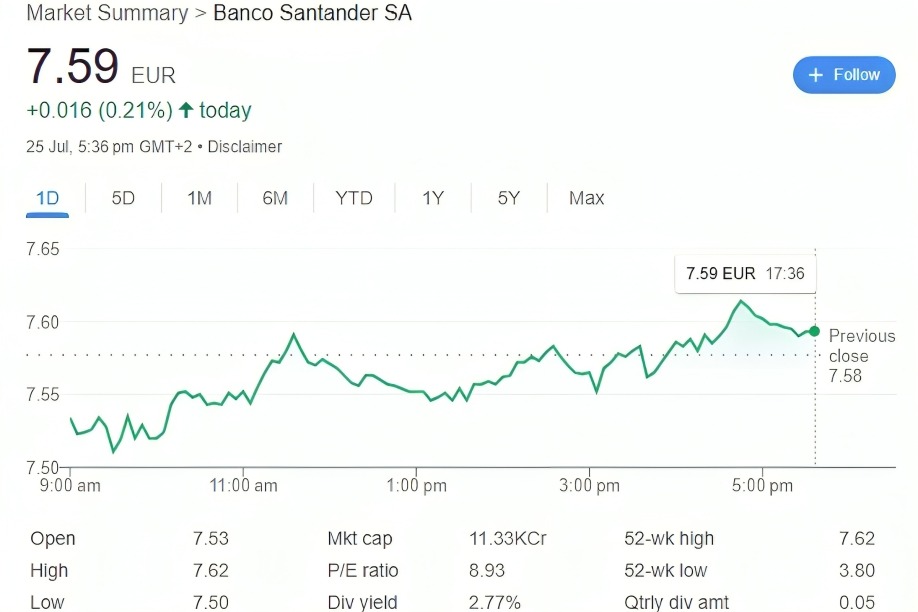

As of yesterday, Santander’s American Depositary Receipt (SAN) was trading at $8.93, up from a previous close of $8.88. That’s the New York listing, which is what most people check.

But here’s the thing that confuses everyone. Santander trades on loads of different exchanges. The bank’s shares are listed in Spain, Mexico, Warsaw, New York, and London. Different prices on each one because of exchange rates and local market conditions.

My dad’s been checking the London price (BNC), which moves differently from the New York one. No wonder he’s confused.

The London shares have been bouncing between 622p and 664p recently. Over the past year, the stock has hit a high of 664.00p and a low of 326.50p. That’s quite a journey.

Why I Started Paying Attention

Wasn’t even looking at bank shares originally. But my mate Dave works in finance and kept banging on about European banks being cheap.

“Look at Santander,” he said over a pint last month. “Massive operation, pays decent dividends, nobody’s interested because everyone thinks European banks are rubbish.”

Did a bit of digging. Turns out Santander‘s pretty huge. Operations across Europe, Latin America, and the US. Not just some local Spanish bank.

The dividend caught my eye. Banks that pay regular dividends usually have their act together. Plus, Dave’s right about European banks being ignored. Everyone’s obsessed with American tech stocks.

What Actually Moves This Share Price

Interest Rates Matter Big Time: Banks make money on the difference between what they pay for deposits and what they charge for loans. When interest rates go up, that gap usually gets bigger.

We’ve had rates going up for ages. It should be good for banks like Santander. But it’s not that simple, is it?

Higher rates also mean more people struggle to pay back loans. Bad debts go up. Profits get squeezed from the other direction.

Latin America’s a Wild Card: Santander makes loads of money in countries like Brazil and Mexico. When those economies do well, Santander does well. When they struggle, the share price gets hammered.

Currency swings make it even more complicated. A strong dollar usually means less profit when they convert everything back to euros.

European Banking Regulations: The European Central Bank keeps changing the rules about how much cash banks need to hold. More rules usually mean lower profits. Investors hate that.

Brexit’s still causing headaches too. Santander’s got big UK operations. Every time there’s political drama, the share price wobbles.

The Real Numbers Behind the Hype

Santander has a market capitalisation of £97.52 billion, with approximately 14.87 billion shares in issue. That’s proper big company territory.

But size doesn’t always mean stability. Big banks can have big problems.

Analysts covering Santander currently have a consensus target price of 640.91p, which is about 3% above the recent closing price of 622.00p. Not exactly screaming “buy” but not terrible either.

The thing about analyst targets is they’re often wrong. I’ve seen shares hit target prices and then immediately crash. Or ignore the targets completely and rocket up.

What My Dad Doesn’t Get About Share Prices

Every morning, he checks the Santander share price today like it’s the weather forecast. Gets excited when it’s up 2p, worried when it’s down 3p.

“Dad,” I keep telling him, “daily moves don’t matter unless you’re day trading.”

He bought these shares as a long-term investment. Whether they’re 620p or 630p today makes no difference if he’s holding for five years.

But try explaining that to someone who grew up checking football scores in the paper once a day. The constant updates are addictive.

The Bigger Picture Everyone Misses

Banking shares aren’t about excitement. They’re about boring, steady profits over time. Santander’s been around since 1857. Survived wars, recessions, and financial crises.

The bank makes money when people need loans, mortgages, or business financing. That’s not going anywhere, whatever the tech bros say about cryptocurrency.

Sure, the share price goes up and down. But the underlying business keeps grinding away, making profits and paying dividends.

What I Actually Think About This Stock

Santander’s not going to make you rich overnight. It’s not the next Tesla or Amazon. It’s a bank.

But banks that pay dividends and don’t go bust have their place. Especially when everyone else is chasing the latest AI stock or whatever.

The share price will keep bouncing around. Some days you’ll feel clever for buying it. Other days you’ll wonder what you were thinking.

That’s just how markets work.

My Advice to Dad (And Anyone Else)

Stop checking the Santander share price today every five minutes. Set up alerts if you must, but only for big moves.

Think about why you bought the shares in the first place. If nothing’s changed about the company, daily price moves don’t matter.

And for crying out loud, don’t panic sell every time there’s bad news. Banks have been through worse than whatever’s happening today.

Bottom Line

Santander’s a big, established bank with operations worldwide. The share price reflects that. Some days good, some days not so good.

If you’re looking for excitement, buy lottery tickets. If you want steady, boring returns with decent dividends, banks like Santander do the job.

Just don’t expect me to explain every daily move to my dad. That’s what financial advisers are for.